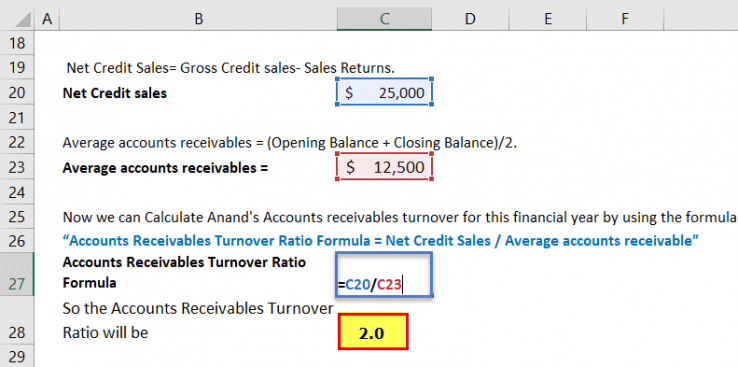

Both numbers should represent the same accounting period. Calculate the accounts receivable turnover ratio.This number forms the nominator in the equation. This is the revenue generated from credit sales, minus any returns. This gets you the denominator in the equation, the average accounts receivable. Add the value of AR at the beginning of your desired period, to the value at the end and divide by two.

Whats a good ar turnover ratio how to#

How to Calculate Accounts Receivable Turnover Ratio (Step by Step) Revenue in each period is multiplied by the turnover days and divided by the number of days in the period. The AR balance is based on the average number of days in which revenue is received. In order to know the average number of days it takes a client to pay on a credit sale, the ratio should be divided by 365 days. In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. Net Annual Credit Sales ÷ Average Accounts Receivables = AR TurnoverĪccounts Receivables Turnover Ratio ÷ 365 = AR Turnover (in days)

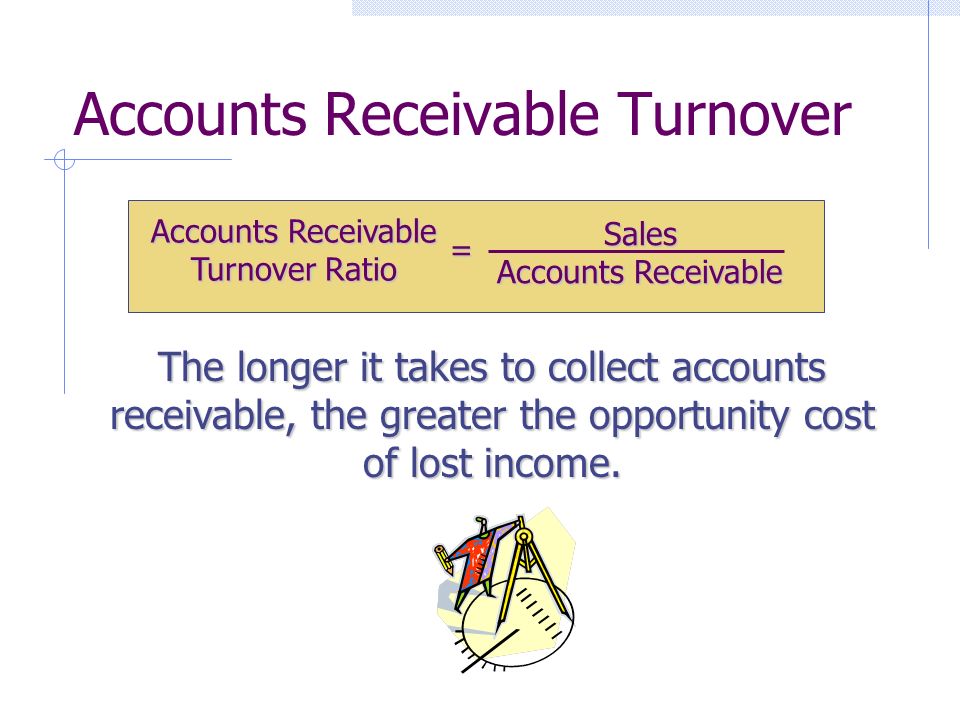

(Beginning Accounts Receivable + Ending Accounts Receivable) ÷ 2 = Average AR Gross Sales – Refunds/Returns – Sales on Credit = Net Sales That number is then divided by 2 to determine an accurate financial ratio. Net sales is everything left over after returns, sales on credit, and sales allowances are subtracted.Īverage accounts receivables is calculated as the sum of the starting and ending receivables over a set period of time (usually a month, quarter, or year). The Accounts receivable turnover ratio is calculated by dividing net credit sales by the average accounts receivable. Calculating Accounts Receivable Turnover Ratio The ratio itself measures how many times a company collects AR (on average) throughout the year. The ratio is also used to quantify how well a company manages the credit they extend to customers, and how long it takes to collect the outstanding debt. This includes automated invoicing, PO matching, and bank reconciliation.

Whats a good ar turnover ratio manual#

The AR turnover ratio is an efficiency ratio that measures how many times a year (or set accounting period) that a company collects its average accounts receivable.The higher the ratio, the better the business is at managing customer credit. It is calculated by dividing net credit sales by average accounts receivable. The accounts receivable turnover ratio is a simple metric that is used to measure how effective a business is at collecting debt and extending credit. Tips for Improving Your Accounts Receivable (AR) Turnover Ratio.High Accounts Receivable Turnover Ratio.Examples of Accounts Receivable Turnover Ratio.When is the Accounts Receivable Turnover Ratio Used?.How to Calculate Accounts Receivable Turnover Ratio (Step by Step).Calculating Accounts Receivable Turnover Ratio.What is Accounts Receivable Turnover Ratio?.The FinTalk Blog Strategy and trends in payments.Customer Stories See how we transform finance operations.Why Tipalti A modern, holistic, powerful payables solution that scales with your changing business needs.

The Tipalti Platform Global, scalable, and fully automated.Expenses Mobile ready integrated expenses and global reimbursements.Global Partner Payments Scalable mass payout solutions for the gig, ad tech, sharing, and marketplace economies.Procurement Complete control and visibility over corporate spend.Accounts Payable Automation End-to-end, global payables solution designed for growing companies.

0 kommentar(er)

0 kommentar(er)